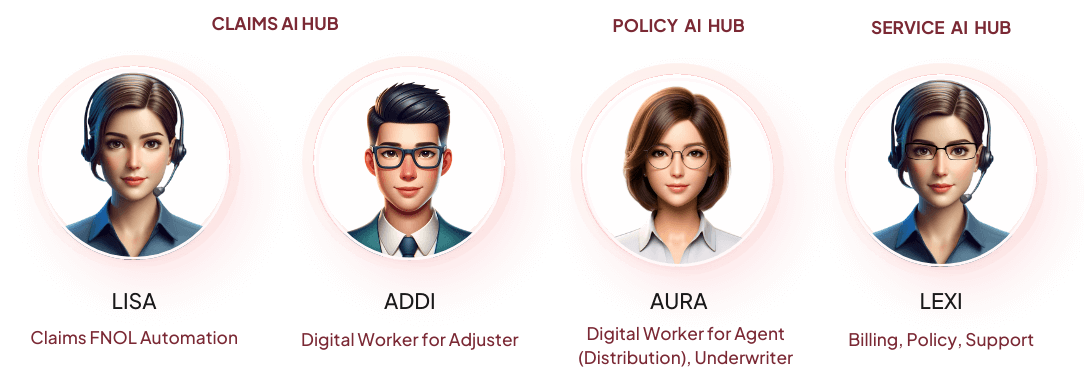

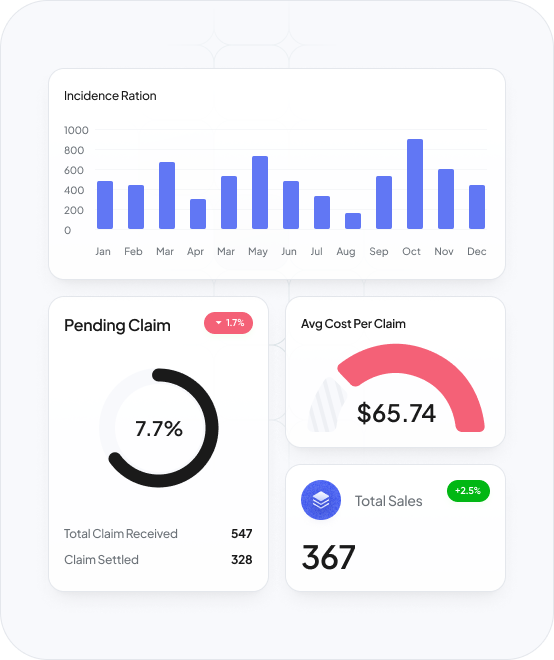

Generative AI-Powered, LLM-Driven Insurance AI Hub for

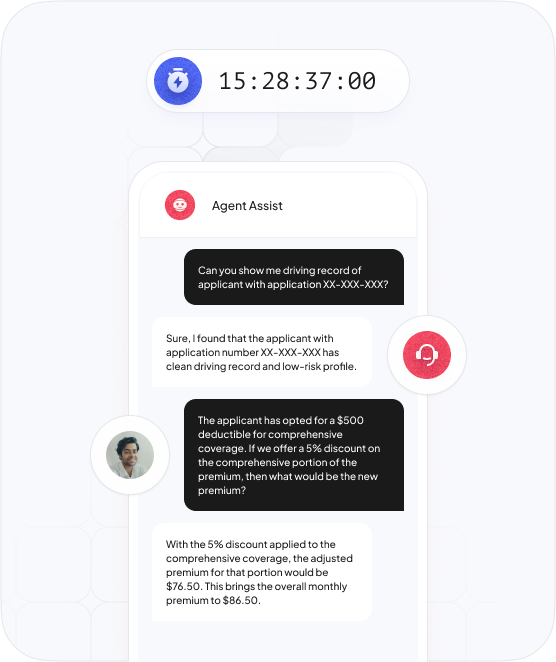

Claims

Policy

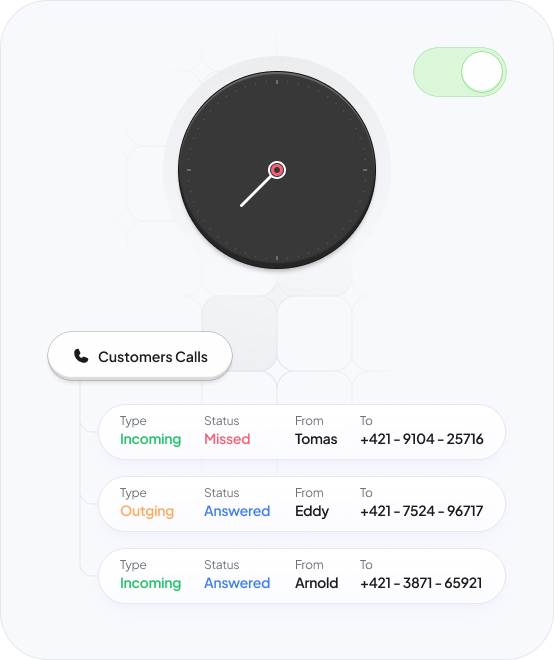

Service

Empower your insurance operations & customers at every step with LISA, ADDI, AURA, & LEXI - from automating Claims FNOL filing, finding relevant information, to evaluating plans & policies to post-purchase support.